Is Business Entertainment Deductible In 2024 – one of your business contacts got the meal, and the cost of the meal didn’t include a charge for entertainment. In 2021 and 2022, this deduction was temporarily enhanced to 100% as a pandemic-era . insurance and other costs that are required for your business to operate. This includes lease payments for buildings and even entertainment costs, although the IRS limits deduction for meals and .

Is Business Entertainment Deductible In 2024

Source : ledgergurus.comHow to Deduct Meals and Entertainment in 2024

Source : www.bench.coMeal and Entertainment Deductions for 2023 2024

Source : ledgergurus.comThe Ultimate 2024 Tax Deductions Checklist for Insurance Agents

Source : blog.newhorizonsmktg.comDeducting Meals as a Business Expense

Source : www.thebalancemoney.comMeals & Entertainment Deductions for 2021 & 2022

Source : www.cainwatters.comAmazon.com: Lower Your Taxes BIG TIME! 2023 2024: Small Business

Source : www.amazon.com25 Small Business Tax Deductions (2024)

Source : www.freshbooks.com2024 01/18 Deducting advertising costs for businesses EG

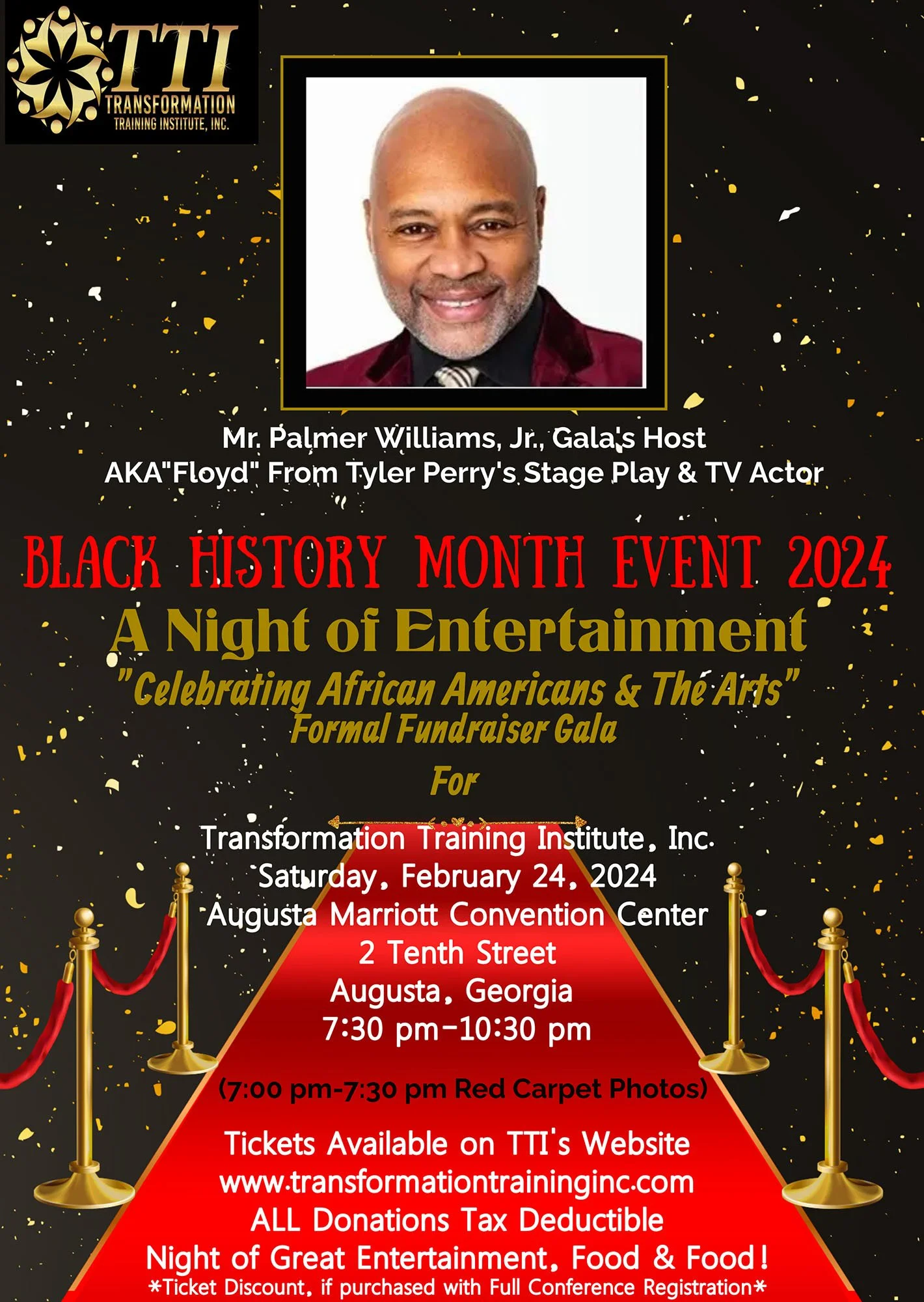

Source : egconleyblog.comFundraiser Gala 2024 | Transformation Training Institute, Inc

Source : www.transformationtraininginc.comIs Business Entertainment Deductible In 2024 Meal and Entertainment Deductions for 2023 2024: If you conduct a staff meeting away from your business location, transportation is 100 percent deductible, as is the cost of the event itself. If you have entertainment at this event, that too is . To avoid the risk of an unwanted audit come filing time, you should be careful when including these eight things as tax deductibles Which business expenses are not tax deductib .

]]>

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)