Illinois Form 941 For 2024 – You pay the federal employer taxes on a quarterly basis–March, June, September and December–and submit the payment with Internal Revenue Service Form 941. You can obtain a copy of the 941 Form . Do you need a business license to sell in Illinois? Illinois Business Registration Application (Form REG-1) – Businesses selling goods and services must register with the Illinois Department of .

Illinois Form 941 For 2024

Source : www.uslegalforms.comIl 2022 2024 Form Fill Out and Sign Printable PDF Template | signNow

Source : www.signnow.com3.11.13 Employment Tax Returns | Internal Revenue Service

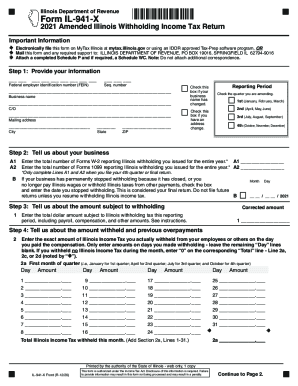

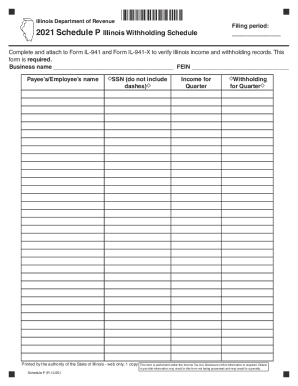

Source : www.irs.govIL IL 941 X Schedule P 2021 2024 Fill out Tax Template Online

Source : www.uslegalforms.com3.11.13 Employment Tax Returns | Internal Revenue Service

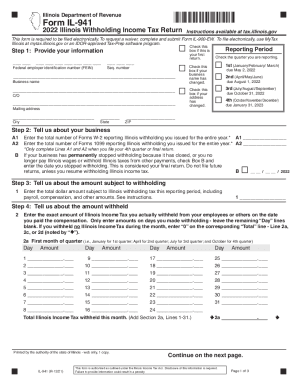

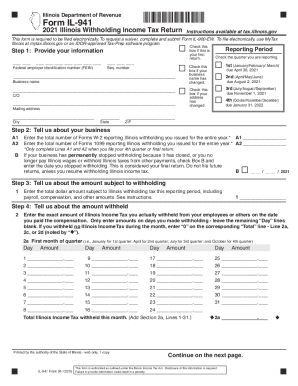

Source : www.irs.govIL DoR IL 941 2021 2024 Fill out Tax Template Online

Source : www.uslegalforms.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov941 correction: Fill out & sign online | DocHub

Source : www.dochub.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov2023 Form IL DoR IL 941 X Fill Online, Printable, Fillable, Blank

Source : form-il-941-x.pdffiller.comIllinois Form 941 For 2024 IL DoR IL 941 X 2021 2024 Fill out Tax Template Online: The Illinois State Police (ISP) Special Investigations Unit (SIU) has created an online form for citizens to report suspected corruption directly to the ISP. “The Illinois State Police Special . IRS Form 941 is the quarterly payroll tax return required for businesses with employees. Form 941 is due quarterly on April 30th, July 31st, October 31st and January 31st. Form 944 is used instead .

]]>